EVERY YEAR ABOUT THIS TIME, my blood pressure temporarily spikes in response to my anger. Anger about ever-rising health insurance premiums depleting our family pocketbook faster than a pick pocket.

I’ve vented and raged and spewed my discontent here. My jaw drops. My mind thinks a few unprintable words. My stress rises. How can we continue to pay these astronomical premiums and still have money for basic needs like food, gas, utilities, clothes, etc? I am thankful Randy and I paid off our mortgage decades ago, that our three kids are out of college and independent, that we’re OK driving aging (2003 and 2005) vehicles… We’ve always been, out of necessity, fiscally conservative, just as we were raised within poor rural families.

Let’s break it down. Health insurance premiums for my husband and me (I’m on his work plan) will go up $190 from $873/month to $1,000/month in 2018. That’s for each of us. Randy’s employer pays half his premium, $500. So we will shell out $1,500/month, or $18,000/annually. But before insurance kicks in, we must pay $3,600 each in deductibles. Alright then.

Let’s recrunch those numbers. In reality, our premiums are $1,300/month each if we need medical care and reach our deductibles. Times two, that’s $2,600/month or $31,200/year. Subtract the $6,000 Randy’s employer pays for his insurance and we’re down to $25,200. Still.

This year I met my $3,700 deductible. But I paid out $14,176 in premiums and deductible for around $4,000 (maybe a bit more; some bills haven’t processed yet) in medical expenses. I’m no math whiz. But even I can see that makes zero financial sense.

Holy, cow.

Somehow we’ve managed on a modest income, Randy’s as an automotive machinist and mine as a self-employed photographer and writer. But these latest insurance premium hikes are pushing us to a financial breaking point. I need to figure out an alternative to the $1,500 to be deducted from Randy’s paychecks each month for health insurance in 2018. Our incomes are not increasing to meet this through-the-roof expense.

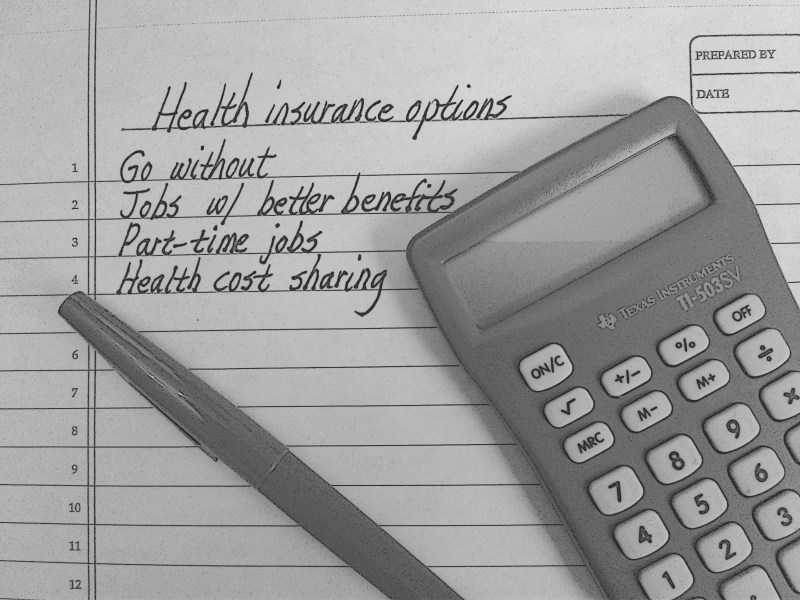

My kneejerk brainstorming produced the following options and reactions:

- Go without health insurance. Not a good idea given our ages and the financial risk.

- Find jobs with better benefits. At age 61, that’s unlikely.

- Take on second part-time jobs.

- Use a Christian-based health cost sharing plan. A strong possibility that requires additional investigation.

Our eldest daughter suggested we move to Canada with its publicly-financed healthcare. I know little about that system. But in a recent conversation with a Canadian visiting her brother here in Minnesota, I heard all about the shortage of doctors and the months of waiting to see one. Even if you’re seriously ill. No, thank you. Besides, I won’t move that far from my granddaughter.

There you go. Now, on to the research, the discussions, the continuing frustration and anger and stress and number crunching that each autumn overtake me.

I’ve joked with Randy that soon he’ll pay his employer to work because nothing will remain of his paychecks. I wish that statement didn’t feel uncomfortably close to reality.

#

AS BAD AS THE RATE HIKES would be for us, I know it could be worse. I’ve seen rates from a major carrier for individual off-exchange health insurance in my county of Rice and seven other southern Minnesota counties. If I chose the bronze plan (least expensive) with a $6,650 deductible, my monthly premium would be $1,361. Take that premium and deductible times two (there would be no subsidy from Randy’s employer) and our health coverage would cost $45,964 before medical bills would be covered. Holy cow. Who can afford that? Not us.

I realize many of you, especially self-employed small business owners or employees of small businesses, are dealing with the same absurd health insurance premiums. I don’t have an answer. I just know that the escalating cost of health insurance is creating a personal financial crisis for many of us. Additionally, because of those costs and matching high deductibles, we can’t afford medical care. Now does that make sense?

#

TELL ME: Are you dealing with/facing similar skyrocketing health insurance premiums? I’d like to hear about your situation and what you are doing. Are you going without insurance? Selected another option? Found a job with better benefits? Whatever you have done, or haven’t, I’m listening.

Please note that I moderate all comments. So please keep the discussion on topic and civil.

© Copyright 2017 Audrey Kletscher Helbling

Recent Comments