Me, the day before surgery, with my hair cut easy-care short. The praying woman oil painting behind me was done by my friend Rhody Yule (now deceased) and hangs on my living room wall.

SURGERY DONE. CHECK.

Healing and recovery. In progress.

With a plate screwed into my broken left wrist during surgery Monday morning at District One Hospital Allina Health, Faribault, I am now moving toward mending the bone I broke after falling on rain-slicked wooden steps at a friends’ house 10 days ago.

This marks my second simultaneous summer with a broken bone In late May 2017, I missed the bottom step on a hospital stairway, plunged into the concrete floor and broke my right shoulder. And, yes, that would be the very same hospital where I underwent surgery yesterday morning. That May evening a year ago, I was on my way to donate blood. Yesterday a nurse asked if I would accept a transfusion if needed. I didn’t require one. But the nurse wondered aloud if you get free units of blood if you’re a donor. Nope, not that I know.

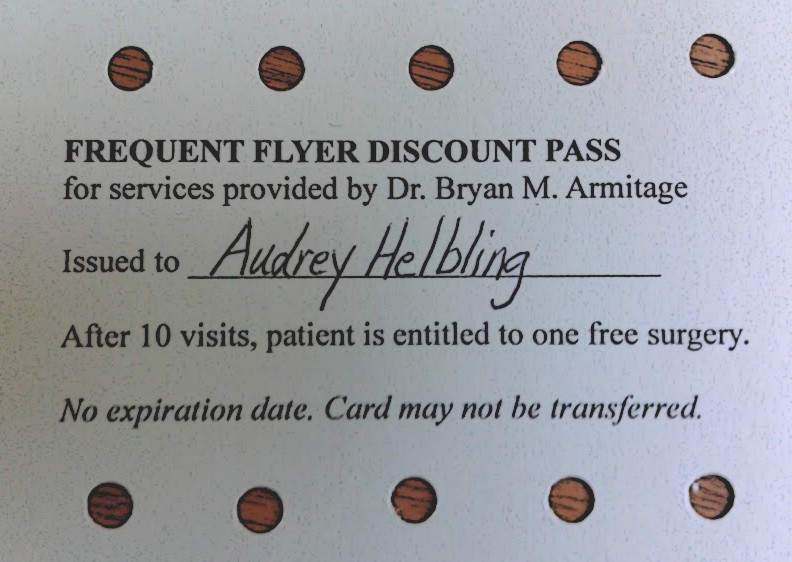

Her comment sparked from a document I created on my computer and brought to the hospital for my surgeon yesterday. Dr. Bryan Armitage has a great sense of humor or I wouldn’t have crafted the Frequent Flyer Discount card I handed to him. He was ready with a quick suggestion to submit my “one free surgery after 10 visits” card to the billing department given he just does the surgery. I persuaded him to accept the card, which he intends to hang above his office desk.

You have to find humor in a serious situation. And, believe me, I needed laughter yesterday prior to surgery.

On a serious note, I am grateful for the skills, compassion and care of my entire medical team. Seasoned nurse Kris and about to graduate nurse Shelby provided excellent pre op and post op care. And there’s that I just do the surgery orthopedic surgeon who worked his magic. I am grateful to all the reassuring (no, you won’t be awake during surgery, I promise) staff who cared for me during my six-hour outpatient hospital stay.

And I am grateful to my husband, Randy, for his attentive and loving care. He’s the best.

Likewise, I appreciate the many prayers and well wishes; cards, gifts and food sent and delivered (thanks, especially, to my niece Amber for the meals); and for the flowers from my wonderful husband. I feel so loved.

Other than being overly tired and experiencing some pain, swelling and tingling, I am doing remarkably well. Given my dislike of pain meds, I am taking only the minimum dosage paired with icing and elevating. That plan is working thus far.

That’s the latest from here as I continue in recovery mode.

One more thing: I weighed 20 pounds less on the hospital surgery scale than I did on the ER scale nine days prior. Vindicated for the third time. Read all about that miraculous weight loss by clicking here.

© copyright 2018 Audrey Kletscher Helbling

Recent Comments